One of the things I've learned running my own business: Nobody Tells You Things.

I always thought that information about things changing that would affect a shop or business would be coming to said shops and businesses. Say, for instance, that there's a change in VAT rate - the tax you have to charge for every sale.

If you have a business in Germany, you're listed and registered. At the very least, your home town has your registration as a business. You might also be registered in some other institutions or thingummies, but let's leave that aside - one registration, which is in your town and thus an official state registration, that's enough.

So in theory, since you are registered and the state should sort of have an interest in having you comply with rules and regulations... I'd have expected some letter or email or notice about that change in VAT rules to come to each business. Not necessarily a long explanation or precise instructions, mind. Just something like a heads-up, as in "there'll be a change, please check if that applies to your business and inform yourself".

Just in case you're also in the Fluffy Bunny Wonderland of Imagination and Incredible Optimism, like I was about this once upon a time, let me burst your bubble: This is not so. Nobody official from the town, or from the state, or from the EU, or from any other stately place, ever tells you anything about upcoming rules or changes. Ever. EVER. You have to miraculously find out about things yourself... or fail to do so, and then maybe eventually fail to comply with rules. The most you can hope for then is an admonishment if your failure to comply comes out somehow, and maybe you'll have to pay a fine then, too.

The long-time readers of you will remember the issue with VAT-MOSS (or VAT-MESS) some 5 years back, when VAT rules for digital goods sales across borders were changed, and caught a lot of vendors unaware. Back then, already, it was hinted that similar rules should be introduced for physical goods as well. This is now going to happen; it was planned to start in January 2021, but has been postponed to July because of the pandemic. I accidentally learned about that this morning... which meant I spent half the morning reading up on stuff to find out what I'll have to do come July.

The good news is: looks like I'll have to do exactly... nothing. My business, and thus my export volume, is small enough to fall under the annual export threshold, which, thank goodness, has been set into place right from the start (as opposed to when the digital sales VAT changed). As a side effect, I've also found out that a similar threshold has been put into place for sales of digital goods, which is fantastic as I'll be able to sell digital instructions and knitting patterns from my shop again. (That threshold introduction happened at sometime back between 2015 and now, and I totally missed it.)

So. Phew. A burst of adrenaline, and then good news - that's an okay outcome of this. And I confess, should you now all conspire to order so many things outside of Germany but within the EU to lift me over the threshold, I'd be totally cool to register for the One-Stop-Shop for my taxes and do the fancy changes to the shop system that would be necessary. (If you want to know, it would mean to look up the tax rates for each of the 27 member states and what they apply to, as books and other printed goods are sometimes taxed with a reduced rate and sometimes not at all, then enter those taxes in the shop system accordingly for each country. Then test all that to make sure it functions properly. That is probably a workday, if it's going badly, more.)

After this little intermezzo... I can now tackle my overly long list of things again. Hooray!

I always thought that information about things changing that would affect a shop or business would be coming to said shops and businesses. Say, for instance, that there's a change in VAT rate - the tax you have to charge for every sale.

If you have a business in Germany, you're listed and registered. At the very least, your home town has your registration as a business. You might also be registered in some other institutions or thingummies, but let's leave that aside - one registration, which is in your town and thus an official state registration, that's enough.

So in theory, since you are registered and the state should sort of have an interest in having you comply with rules and regulations... I'd have expected some letter or email or notice about that change in VAT rules to come to each business. Not necessarily a long explanation or precise instructions, mind. Just something like a heads-up, as in "there'll be a change, please check if that applies to your business and inform yourself".

Just in case you're also in the Fluffy Bunny Wonderland of Imagination and Incredible Optimism, like I was about this once upon a time, let me burst your bubble: This is not so. Nobody official from the town, or from the state, or from the EU, or from any other stately place, ever tells you anything about upcoming rules or changes. Ever. EVER. You have to miraculously find out about things yourself... or fail to do so, and then maybe eventually fail to comply with rules. The most you can hope for then is an admonishment if your failure to comply comes out somehow, and maybe you'll have to pay a fine then, too.

The long-time readers of you will remember the issue with VAT-MOSS (or VAT-MESS) some 5 years back, when VAT rules for digital goods sales across borders were changed, and caught a lot of vendors unaware. Back then, already, it was hinted that similar rules should be introduced for physical goods as well. This is now going to happen; it was planned to start in January 2021, but has been postponed to July because of the pandemic. I accidentally learned about that this morning... which meant I spent half the morning reading up on stuff to find out what I'll have to do come July.

The good news is: looks like I'll have to do exactly... nothing. My business, and thus my export volume, is small enough to fall under the annual export threshold, which, thank goodness, has been set into place right from the start (as opposed to when the digital sales VAT changed). As a side effect, I've also found out that a similar threshold has been put into place for sales of digital goods, which is fantastic as I'll be able to sell digital instructions and knitting patterns from my shop again. (That threshold introduction happened at sometime back between 2015 and now, and I totally missed it.)

So. Phew. A burst of adrenaline, and then good news - that's an okay outcome of this. And I confess, should you now all conspire to order so many things outside of Germany but within the EU to lift me over the threshold, I'd be totally cool to register for the One-Stop-Shop for my taxes and do the fancy changes to the shop system that would be necessary. (If you want to know, it would mean to look up the tax rates for each of the 27 member states and what they apply to, as books and other printed goods are sometimes taxed with a reduced rate and sometimes not at all, then enter those taxes in the shop system accordingly for each country. Then test all that to make sure it functions properly. That is probably a workday, if it's going badly, more.)

After this little intermezzo... I can now tackle my overly long list of things again. Hooray!

This is how much ground you can cover with 5 m of gold thread.

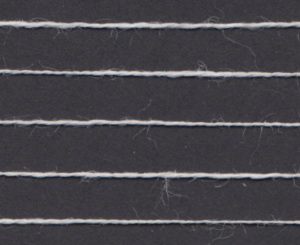

This is how much ground you can cover with 5 m of gold thread. Three-ply linen yarn - that is my

Three-ply linen yarn - that is my  Two-ply linen yarn, about the same thickness - that is

Two-ply linen yarn, about the same thickness - that is